Bidding on this year’s glut of tax-foreclosed homes in Wayne County has wrapped up.

Final numbers aren't available yet. But the annual auction has become a real estate mega-event in recent years, as tax foreclosures have soared and flooded the market with delinquent properties.

And critics say that cycle is bound to continue if fundamental changes aren’t made.

More than 28,000 properties went on the online auction block this year. The vast majority are in Detroit.

Ted Phillips, director of the United Community Housing Coalition in Detroit, says tens of thousands more properties that went into foreclosure avoided going to auction.

In part, that’s because state lawmakers made changes that allowed more struggling homeowners to get on payment plans, in some cases cutting the amount of back taxes owed and offering reduced interest rates.

“Nevertheless, there still appears to have been 3500 or so homeowner-occupied homes in Detroit, and a few thousand others that were tenant-occupied, that ended up going to auction sale,” said Phillips. “And as a general rule that is a very bad thing, and it’s going to cause a lot of devastation.”

Phillips said both city and county officials need to do a better job letting homeowners know about programs that could help them reduce or even eliminate their tax bills. In fact, Detroit has a little-known property tax exemption for people living in poverty.

“The problem is you have to apply each year. A lot of people don’t know that,” Phillips said. “They don’t apply, and by the time you’re in tax foreclosure three years later, it’s too late then.”

In past years, the United Community Housing Coalition used the tax auction as a last resort to help people in foreclosure buy their homes back. But they couldn’t do that this year, because of changes to state law forbidding delinquent homeowners from winning properties back that way.

While that was meant to close a loophole for tax scofflaws and stem the foreclosure cycle, Phillips thinks it also takes a last-resort tool away from some genuinely struggling homeowners.

“Lansing needs to re-think the whole issue of whether homeowner-occupants should be allowed to bid,” Phillips said. “If nothing else worked, people should have a right through the auction process to get a re-set, and be able to keep their home.”

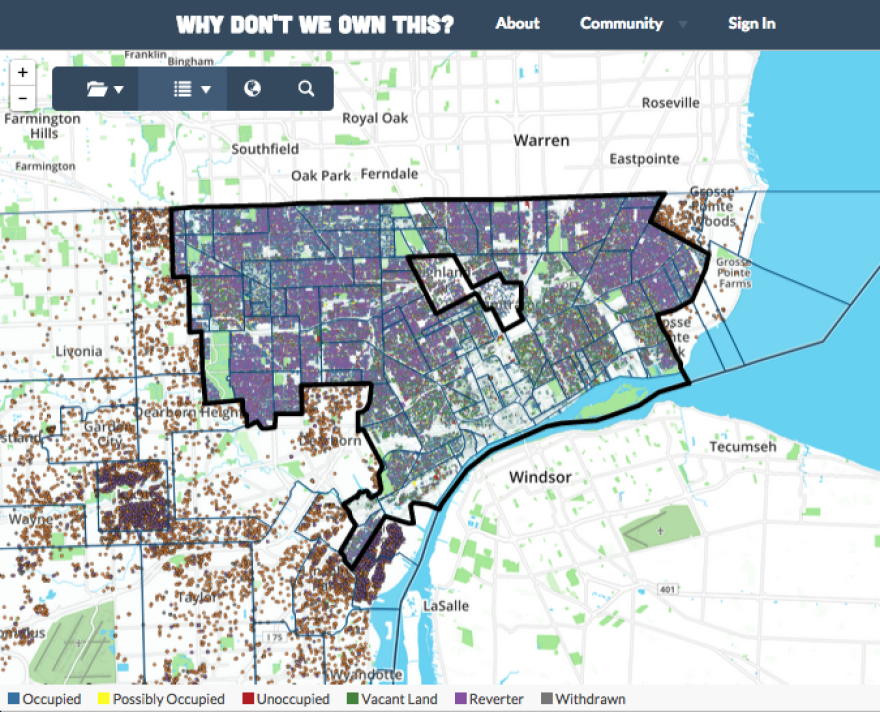

Jerry Paffendorf is CEO and co-founder of Loveland Technologies, which has tracked Wayne County auction data for years.

He says it would help if city and county officials used new data about a property’s history and occupancy to help make the process more “intelligent and humane.”

“We have no idea who and what we’re foreclosing on,” Paffendorf said. “And if you pause and think about that, it’s almost unconscionable the way we’re currently behaving. We’re foreclosing on things without knowing what they are, and then we’re putting them onto the random craps table of the slot machine of the auction.”

Paffendorf, now a candidate for interim Wayne County treasurer, cites two measures he thinks would make a big difference: visiting every foreclosed property to actually talk with and inform occupants; and working behind the scenes to get Detroit property taxes more in line with reality.

It’s common knowledge that many Detroit properties are hugely over-assessed, resulting sometimes in tax bills far exceeding a home's actual value.

Detroit is in the midst of its first city-wide reassessment process in 50 years. But Detroit Mayor Mike Duggan says it won’t be complete until at least late 2016, so tax delinquencies based on inflated assessments will keep piling up for several more years.

In the meantime, Paffendorf says neither the city nor county has much financial incentive to make immediate changes. “They both actually collect a lot of money through delinquent taxes,” he says.

That’s because under state law, Wayne County basically insures Detroit against any unpaid property taxes. Wayne County assumes that debt, and then acts as the city’s debt collector.

“And then the county, as a collection agency, is able to levy high interest rates and penalties on the people who do pay late,” Paffendorf says. “And so the city gets the money that it wants to collect no matter what, and the county makes a lot of money, tens of millions of dollars a year, in surplus.”

County officials say they’re just following state law, which requires the county to foreclose and auction off all properties that are tax-delinquent after three years.

Foreclosure notices for the 2016 cycle are already going out. Around 62,000 Detroit properties are expected to receive notices. More than 40,000 are occupied residences.